Warren And Warner Call for Action on Housing Finance Infrastructure

Wednesday, November 19, 2014

The six areas the senators addressed included developing single security for Fannie Mae and Freddie Mac securities, developing regulations of these securities that would guarantee loans, and updating the credit scoring models these companies use. Also, continued experimentation in risk-sharing programs, making the Common Securitization Platform transparent and efficient, and improving the First Look Program.

In the letter, the senators said, "While we applaud FHFA for developing this program, we believe there are ways to strengthen it. We ask you to consider whether there are ways to further encourage purchases by owner-occupants, such as increasing the amount of time they have to bid on such properties or lowering the prices of the homes during the First Look period.

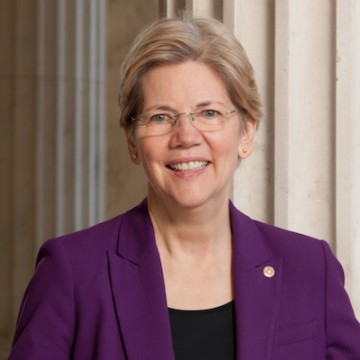

"Millions of credit worthy families are struggling to get mortgages and buy a home," said Senator Warren. "We believe FHFA can use its existing authority to extend credit to responsible families and, at the same time, prepare the housing finance system for the end of government conservatorship."

"While we work in Congress to pass comprehensive housing finance reform, we are asking FHFA to move responsibly and transparently as they lay the foundation for a system that better protects taxpayers and improves access to credit for homeowners," said Senator Warner.

The letter expressed the need for comprehensive reform. The senators stated, "We believe that the government conservatorship of Fannie Mae and Freddie Mac (the Enterprises) is not a long-term solution to provide access to mortgages, and that Congress should enact comprehensive housing finance reform. However, we also believe that, in the interim, the Federal Housing Finance Agency (FHFA) can and should take steps to build a housing finance infrastructure for the future, enhance the role of private capital in the agency mortgage-backed security (MBS) market, and responsibly increase access to mortgage credit."

Related Slideshow: Worcester Neighborhoods with the Highest Housing Costs

How much do Worcester residents spend of their income on housing? Looking specifically at homes with mortgages, the website Rich Blocks, Poor Blocks crunched the most recently available census data to show how much Worcester homeowners pay annually for housing.

Below are the top ten highest housing cost-to-income ratio neighborhoods in Worcester, based on census tracts. Income and costs are annual figures for homes with a mortgage, and are in 2012 inflation-adjusted dollars.

Source: United States Census' 2008-2012 American Community Survey dataset.

Related Articles

- Elizabeth Warren Lays Out Housing Finance Reform Priorities

- Warren’s Job Approval Rating in Central Mass Only 32 Percent

- Warren Possible Presidential Candidate in 2016 Says HuffPost

- MassFiscal Says Warren’s Minimum Wage Increase “Flawed”

Follow us on Pinterest Google + Facebook Twitter See It Read It