Weiss: Trump Signs Legislation to Undo Nation’s Banking Rules

Monday, May 28, 2018

The Senior Safety Act is part of S. 2155, the “Economic Growth, Regulatory Relief and Consumer Protection Act,” a bill that modified the provisions of the Dodd-Frank Act, which was passed by Congress in 2010 to oversee the financial industry after the financial crash and recession of 2008-09.

Protecting Older Investors from Financial Exploitation

Through the watchdog efforts of the Senate Aging Committee, financial exploitation of seniors was identified as a top senior issue to combat. According to the Government Accountability Office, financial fraud targeting older Americans is a growing epidemic that costs seniors an estimated $2.9 billion annually. These frauds range from the “Jamaican Lottery Scam,” to the IRS impersonation scam, to the financial exploitation of seniors through guardianships. Earlier this year a hearing was held to update the public about the committee’s efforts to combat scams targeting older Americans as well as unveil its 2018.

As the Chairman and former Ranking Member of the Senate Special Committee on Aging, Senators Collins and McCaskill introduced the Senior $afe Act last year. Existing bank privacy laws can make it difficult for financial institutions to report suspected fraud to the proper authorities. The Senior $afe Act address this problem by encouraging banks, credit unions, investment advisors, broker-dealers, insurance companies and insurance agencies to report suspected senor financial fraud. It also protects these institutions from being sued for making reports so long as they have trained their employees and make reports in good faith and on a reasonable basis to the proper authorities.

“As Chairman of the Senate Aging Committee, I have been committed to fighting fraud and financial exploitation targeted at older Americans,” said Senator Collins. “The Senior $afe Act, based on Maine’s innovative program, will empower and encourage our financial service representatives to identify warning signs of common scams and help prevent seniors from becoming victims.”

Judith M. Shaw, Maine Securities Administrator and chair of the North American Securities Administrators Association’s Committee on Senior Issues and Diminished Capacity, says that this legislation incentivizes financial service institutions, including those in the securities industry, to train key employees on the identification and reporting of suspected financial exploitation of seniors. “This is a significant and important tool in the ongoing efforts to protect senior investors,” she adds.

Adds Jaye L. Martin, Executive Director of Legal Services for the Elderly, “We know from our proven success with Senior Safe in Maine that education of financial services professionals is a key component to identifying and stopping financial exploitation of seniors. There is no doubt this bill will help prevent seniors all over the country from becoming victims.”

With the passage of S. 2155, Keith Gillies, President of the National Association of Insurance and Financial Advisors (NAIFAK), said, “The Senior Safe Act provides “much needed protection for older investors and will allow advisors to better protect their clients’ interests.”

“Advisors are often the first line of defense for scammers looking to take advantage of investors,” says Gillies, noting that studies have found older Americans are often a prime target.

The Pros and Cons of S. 2155

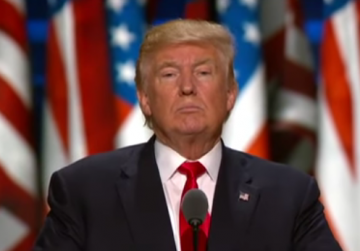

Since the Dodd-Frank legislation’s passage eight years ago, 20 percent of small banks have been put out of business, said President Trump and a ceremony where he signed S. 2155 into law. He predicted that the roll back of the costly banking reform regulations, both “crippling” and “crushing” to community banks and credit unions, would stimulate the banking industry to increase lending to businesses.

Banking regulations made it virtually impossible for new banks to be established to replace those that had closed their doors, said Trump, denying small businesses with access to capital. “By liberating small banks from excessive bureaucracy — and that’s what it was: bureaucracy — we are unleashing the economic potential of our people,” said Trump.

Senator Jon Tester (D-Montana) calls the Economic Growth, Regulatory Relief, and Consumer Protection Act a jobs bill, saying “it is a much-needed solution for the folks who power our local economies.”

In an op-ed in the Greater Fort Wayne Business Weekly, Senator Joe Donnelly (D-Indiana) said, “This banking package is reasonable, balanced, and the result of thoughtful negotiation and compromise. It would take measured steps to encourage community financial institutions to boost lending and provide new protections for consumers. And it’s an example of what we can achieve when we work together to break the gridlock in Washington.”

But others strongly oppose passage of S. 2155.

Although S. 2155 has a provision to protect seniors from financial exploitation, Democratic Policy and Communications Committee Co-Chair David N. Cicilline, expressed strong concerns when the Houses passed S. 2155, he jokingly refers to as “the Bank Lobbyist Act.”

“Ten years ago, Wall Street’s recklessness brought our economy to the brink of collapse. It has taken Rhode Island years to recover. In many ways, we are still recovering.,” noted Rhode Island’s Congressman representing District 1. “The Dodd-Frank financial reform law ended the worst of the Big Banks’ excesses. It established the Consumer Financial Protection Bureau and gave working people a voice against the most powerful corporations in our country,” he said, noting that the passing of S. 2155 has reversed this progress.

It’s a massive giveaway to the wealthy and the middle class is getting screwed. This is a raw deal for working men and women. The American people deserve A Better Deal,” Cicilline said.

Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare, warns that with the deregulation of banks, the GOP “are still gunning for Social Security under the guise of entitlement reform.”

Richtman predicts the passage of S. 2155 and it’s signing into law “makes another financial crisis more likely.”” He asks, “How fair is it to ask workers to be responsible and save when the government strips away protections intended to keep our savings secure?”

“Retirees’ Social Security benefits must be preserved because, at least for now, they are the only thing workers can depend on after the next financial crash,” says Richtman.

The Senior $afe Act was endorsed by organizations, including AARP, the North American Securities Administrators Association (NASAA), the Conference of State Bank Supervisors (CSBS), the Credit Union National Association (CUNA), the National Association of Federally-Insured Credit Unions (NAFCU), the National Association of Insurance Commissioners (NAIC), the National Association of Insurance and Financial Advisors (NAIFA), the Securities Industry and Financial Markets Association (SIFMA), the Insured Retirement Institute (IRI), Transamerica, and LPL Financial.

Herb Weiss, LRI’12, is a Pawtucket writer covering aging, healthcare and medical issues. To purchase Taking Charge: Collected Stories on Aging Boldly, a collection of 79 of his weekly commentaries, go to herbweiss.com

Related Articles

- Weiss: Social Security, Medicare Are Solvent..For Now

- Weiss: GOP Senators Avoid Angry Constituents During July Recess

- Weiss: House Budget Committee Plan Calls for Privatization of Medicare

- Weiss: Three GOP Senators Derail ‘Skinny’ Maneuvers

- Weiss: Report - Cognitive-Simulating Activities Good for Your Brain’s Health

- Weiss: Senate Health Bill Vote Expected This Week, Dems Call Bill “Meaner” Than House Version

- Weiss: Assistance to Employee Caregivers Good for Everyone’s Bottom Line

- Weiss: Experts Say Isolation and Loneliness Impacting More Older Americans

- Weiss: GOP Health Care Reform Moves to Senate

- Weiss: Trump Budget Could Fray Nation’s Social Security Net, Hurt Seniors

- Weiss: On Taking a Stand Against Racism & Antisemitism

- Weiss: Analysis Says That Aging Veterans at Greater Risk of Alzheimer’s Disease

- Weiss: New Report Says Alzheimer’s Disease Is Now Major Public Health Issue

- Weiss: Trump’s Budget Proposal Comes ‘Dead on Arrival’ to Aging Groups

- Weiss: With Tax Day Looming, Watch Out for IRS Imposters

- Weiss: CBO Numbers Says GOP Health Plan Benefits Young, Healthy…Not Seniors

- Weiss: House Fails to Pass GOP’s Balanced Budget Amendment

- Weiss: In 2050, Where Have All the Family Caregivers Gone?

- Weiss: Older Americans to Benefit from Bipartisan Budget Act

- Weiss: Pets Can Bring You Health, Happiness

- Weiss: Senate Aging Panel Calls for Improved Emergency Preparation & Response

- Weiss: Aging Groups - House GOP Tax Rewrite a Turkey

- Weiss: Medicare Takes a Blow Under GOP’s Major Tax Plan Fix

- Weiss: Congress Passes RAISE Family Care Givers Act

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It