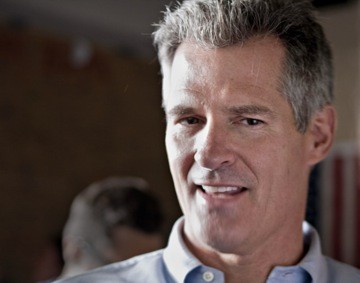

Mass Dems Slam Scott Brown for Tax Plan Vote

Friday, July 27, 2012

“Scott Brown chose once again to stand with his Republican colleagues in Washington instead of middle-class families in Massachusetts,” said Massachusetts Democratic Party Chair John Walsh.

The $250 million Democratic plan maintains a higher earning threshold for the Child Tax Credit, preserves the 2009 expansion of the Earned Income Tax Credit (EITC) for low income individuals, and prevents the American Opportunity Tax Credit, which gives a tax credit for low-income and middle-class families with children in college, from expiring.

But Brown also voted against the $405 billion GOP tax plan that would have extended tax cuts to everyone, including the wealthiest individuals, while letting the tax credits for low income and middle income Americans lapse.

“Now is not the time to raise taxes on anyone,” Brown said in a statement. “We should be working on a bipartisan tax and spending reform plan that keeps rates low for everyone, promotes growth and stability for businesses and families, and restores fiscal balance for future generations.”

Although the Democratic proposal passed it is almost certain to be defeated in the GOP controlled House of Representatives, from which all tax law must originate. As a result, the legislation is largely symbolic.

Senate Minority Leader Mitch McConnell admitted as much, saying that the only reason Republican leadership did not block the bill is because it will not become law.

“What today’s votes are all about is showing the people who sent us here where we stand,” he said.

A press release issued by the Massachusetts Democratic Party cites a report from the Citizens from Tax Justice, which claims that 165,143 families in Massachusetts would save $113.5 million in tax benefits under the Democratic plan, for an average savings of $687 per family.

The press release also states that the plan helps 98% of American families and 97% of small businesses.

Although the Democratic plan allows tax cuts for the highest earners to expire they still benefit under the plan. The Tax Policy Center found that the top one percent of Americans would see their taxes fall by $15,000 under the new legislation. Under the Republican plan the wealthiest Americans would receive a $75,000 cut.

Related Articles

- NEW: Brown Votes For Cap on Student Loan Rate

- NEW: Warren Slams Brown on Environmental Stance

- Will Brown-Warren Deliver Bipartisan Promises?

- BREAKING: Mass Dems. File Ethics Complaint Against Brown

- NEW: Brown and Warren Debate Jobs Study’s Validity

Delivered Free Every

Delivered Free Every

Follow us on Pinterest Google + Facebook Twitter See It Read It