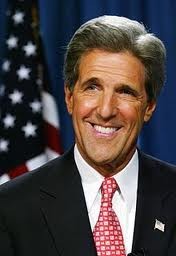

US Senator Kerry Wants Lending Opportunities for Small Biz Coops

Friday, March 02, 2012

“It is my understanding that many small business cooperatives are not currently able to utilize SBA lending programs due to regulations dating back to the 1960s which are currently subject to conflicting interpretations,” Kerry wrote in the letter. “I am concerned that too many lenders see the regulations as a broad denial of access for all cooperatives, even those that otherwise fit the criteria of being a small business.”

Sen. Kerry introduced the Small Business Lending Act last November - legislation that would help to make more capital available to small businesses through the Small Business Administration (SBA), eliminate some SBA loan fees, and increase loan guarantees to help small businesses expand, create jobs, and strengthen the economic recovery.

Related Articles

- NEW: MA Delegation Welcome Stanley Cup to U.S. Capitol

- NEW: Senator Kerry Supports Obama Online Privacy Bill

- US Senator Kerry Supports Obama’s Budget

- PowerPlayer: Congressman Jim McGovern

Follow us on Pinterest Google + Facebook Twitter See It Read It